Australian Wool Production Forecast Report August 2025

The Australian Wool Production Forecasting Committee’s (AWPFC) estimate of shorn wool production for the 2024/25 season is 280.1 Mkg greasy. This is 11.8% lower than the 2023/24 and confirms the forecast made in April 2025.

Summary

- The Australian Wool Production Forecasting Committee’s (AWPFC) estimate of shorn wool production for the 2024/25 season is 280.1 Mkg greasy. This is 11.8% lower than the 2023/24 and confirms the forecast made in April 2025.

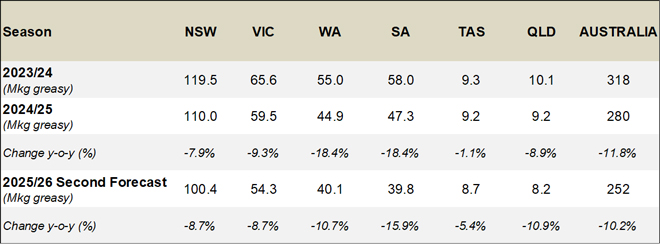

- A year-on-year decline in shorn wool production in 2024/25 was estimated for all states ranging from -18.4% in both WA (44.9 Mkg greasy) and SA (47.3 Mkg greasy) to -1.1% (9.2 Mkg greasy) in Tasmania. NSW produced 110.0 Mkg greasy (down 7.9%), Victoria 59.5 (Mkg greasy (down 9.3%) and Queensland 9.23 Mkg greasy (down 8.9%).

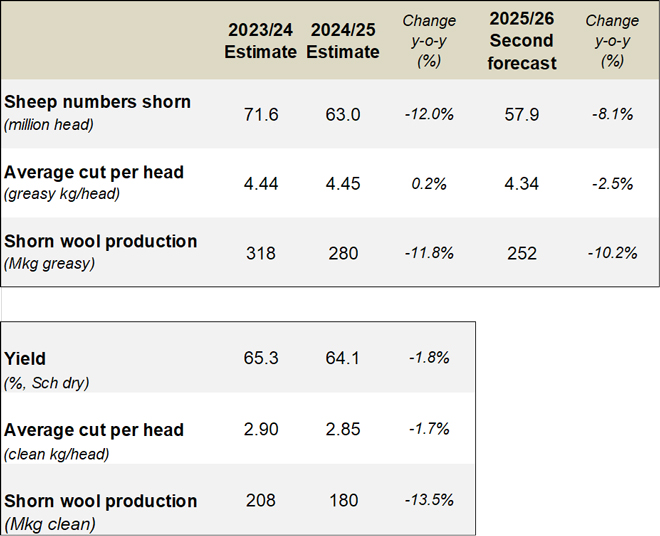

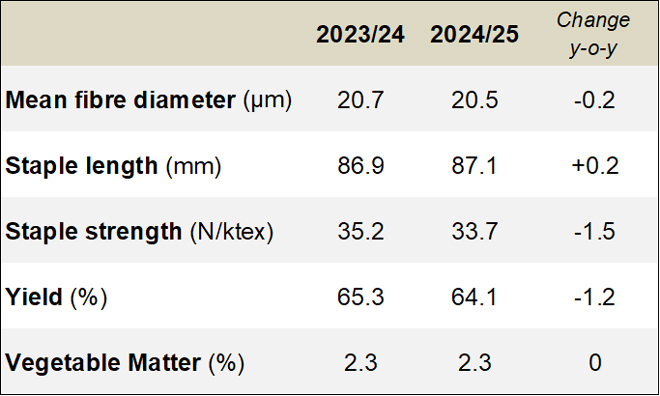

- Average cut per head is forecast to be comparable with 2023/24, at 4.45 kg greasy (up 0.2%). AWTA Key Test Data for the 2024/25 season show small year-on-year reductions in mean fibre diameter (down 0.2 microns), staple strength (down 1.5 N/ktex) and yield (down 1.1%) with a small increase in staple length (up 0.2 mm) and no year-on-year change in vegetable matter (2.2%). These data reflect the difficult seasonal conditions in many states during 2024/25 and the continued dampening impact of the season on average cut per head.

- AWTA wool test volumes for the 2024/25 season were down by 11.7% on a year-on-year basis. Firsthand offered wool at auction during 2024/25 was down by 13.2%.

- Sheep slaughter for 2024/25 was up 13% to 11.7 million head with lamb slaughter at 26.1 million head (down 4%) compared to 2023/24. However, the 2024/25 sheep and lamb slaughter were both higher than the five-year average by 51% and 17% respectively.

- The August AWPFC estimate includes a clean wool estimate for average cut per head and shorn wool production. For the 2024/25 season the yield (%, Schlumberger dry top and noil yield) from the AWTA key test data was used to calculate the clean average cut per head and clean shorn wool production (Table 1).

- The AWPFC’s second forecast of shorn wool production for the 2025/26 season is 251.5 Mkg greasy, a 10.2% decrease on the 2024/25 forecast. Sheep shorn numbers are forecast to reduce by 8.1% to 57.9 million.

- The May 2025 Sheep Producer Intentions Survey indicated continued negative sentiment among wool producers due to challenging seasonal conditions, increasing input costs, workforce shortage as well as supply chain and market pressures. These factors continue to impact sheep producers’ decisions regarding their overall livestock enterprise mix and the breed composition of their sheep flock.

- The Bureau of Meteorology’s outlook for September to November 2025 is for above average median rainfall for most of the eastern half of Australia, but below average rainfall for parts of Western Australia. Above average maximum temperatures are likely to very likely for most key wool producing regions.

- Table 1 summarises Australian wool production and Table 2 shows the total shorn wool production by state. Table 3 provides a comparison of AWTA key test data for the 2024/25 and 2023/24 seasons.

- More detailed information on the shorn wool production by state in 2024/25 can be found in Table A1 in the Appendix to this report.

- The Appendix also provides historical data for Australia, including sheep shorn numbers, average cut per head and shorn wool production (Table A2) as well as the micron profile (Table A3) since 1991/92.

Australian shorn wool production estimate of 280 Mkg greasy in 2024/25 and forecast 252 Mkg greasy for 2025/26

Committee Chairman, Stephen Hill said that "the 2024/25 estimate reflects the continued drought conditions in western Victoria and South Australia and the variable season in both New South Wales and Western Australia”.

The AWPFC’s second forecast of shorn wool production for the 2025/26 season is 251.5 Mkg greasy, a 10.2% decrease on the 2024/25 forecast. Sheep shorn numbers are forecast to reduce by 8.1% to 57.9 million.

“Fewer sheep are expected to be shorn in all states as producers take advantage of the current strong sheepmeat prices” noted Mr Hill. “This remains a key downside risk to a recovery in shorn wool production despite the favourable seasonal outlook in key wool producing regions. Rainfall from now leading into Spring and pasture feed availability will be key factors influencing producer decision making”.

The May 2025 Sheep Producer Intentions Survey indicated continued negative sentiment among wool producers due to challenging seasonal conditions, increasing input costs, workforce shortage as well as supply chain and market pressures. These factors continue to impact sheep producers’ decisions regarding their overall livestock enterprise mix and the breed composition of their sheep flock.

The Committee has estimated a year-on-year decline in shorn wool production in 2024/25 for all states ranging from -18.4% in both WA (44.9 Mkg greasy) and SA (47.3 Mkg greasy) to -1.1% (9.2 Mkg greasy) in Tasmania. NSW produced 110.0 Mkg greasy (down 7.9%), Victoria 59.5 (Mkg greasy (down 9.3%) and Queensland 9.23 Mkg greasy (down 8.9%).

Average cut per head was comparable with 2023/24, at 4.45 kg greasy (up 0.2%). AWTA Key Test Data for the 2024/25 season show small year-on-year reductions in mean fibre diameter (down 0.2 microns), staple strength (down 1.5 N/ktex) and yield (down 1.1%) with a small increase in staple length (up 0.2 mm) and no year-on year change in vegetable matter (2.2%). These data reflect the difficult seasonal conditions in many states during 2024/25 and the continued dampening impact of the season on average cut per head.

AWTA wool test volumes for the 2024/25 season were down by 11.7% on a year-on-year basis. Firsthand offered wool at auction during 2024/25 were down by 13.2%.

Sheep slaughter for 2024/25 was up 13% to 11.7 million head with lamb slaughter at 26.1 million head (down 4%) compared to 2023/24. However, the 2024/25 sheep and lamb slaughter were both higher than the five-year average by 51% and 17% respectively.

The August AWPFC estimate includes a clean wool estimate for average cut per head and shorn wool production. For the 2024/25 season the yield (%, Schlumberger dry top and noil yield) from the AWTA key test data was used to calculate the clean average cut per head and clean shorn wool production (Table 1).

Table 1: Summary of Australian wool production

Note: Totals may not add due to rounding.

Table 2: Total shorn wool production by state

Note: Totals may not add due to rounding.

Table 3: AWTA key test data for 2023/24 and 2024/25 (Full season)

The National Committee drew on advice from the six State Committees, each of which includes growers, brokers, private treaty merchants, sheep pregnancy scanners, representatives from State Departments of Agriculture and the Australian Wool Testing Authority. Data and input were also drawn from AWEX, wool exporters, the Australian Bureau of Statistics, ABARES and Meat and Livestock Australia.

The state and national Committees will next meet in mid-December 2025.

The full forecast report will be available on the AWI website at www.wool.com/forecasts from 1 September 2025.

Released by:

Kevin Wilde

Australian Wool Innovation, General Manager, Consultation and Engagement

Mobile: +61 436 031 277