Market intelligence report

Here we look at the 2024–25 season statistics for Australian wool, which show decreasing production volumes, recovering prices, and China’s continued dominance as an export destination.

Australian 2024–25 wool production by volume

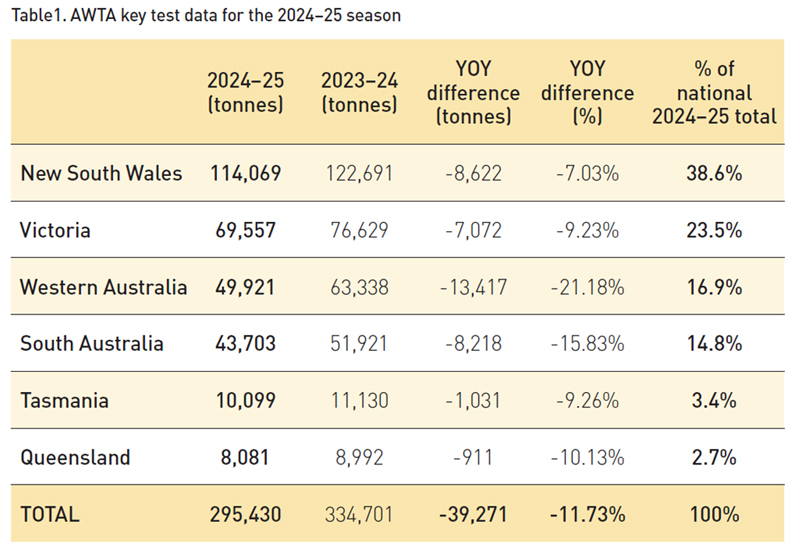

The Australian Wool Testing Authority (AWTA) tested 295.4 million kilograms (mkg) of greasy wool during the 2024–25 season, an 11.7% reduction in wool tested compared to the previous season.

All states had decreases. The biggest production loss was in Western Australia, down 21.2%, due to a combination of trying growing conditions alongside producers adjusting their land use due to changes in Government policy. Despite this, WA remains the third largest producing state at 16.9% of national production. Drought-affected South Australia also saw a big fall in production, down 15.8%.

NSW and Victoria were responsible for 62.1% of national production (59.6% in previous season), with the dominant producing state of NSW accounting for 38.6%, but still down 7.0% in volume for the year. Tasmania (down 9.3%) and Queensland (down 10.1%) also had decreased production, partly due to adverse growing conditions, drought and flood respectively.

Wool selling volumes at auction for the 2024–25 selling season compared to the previous season saw:

- 14.26% less wool offered – 1,541,414 bales offered compared to the 1,797,792 bales offered in the previous season, a drop of 256,378 bales.

- 14.46% less wool sold – 1,419,576 bales sold compared to the 1,659,497 bales sold in the previous season, a drop of 239,921 bales.

- Slightly lower clearance rates at auction – 92.10% compared to the 92.31% cleared in the previous season.

- 13.32% drop in raw wool value, approximately A$298 million less clip revenue – A$1.940 billion sold in 2024–25 through the auction system compared to the A$2.238 billion sold in the previous season.

Australian 2024–25 wool production by micron

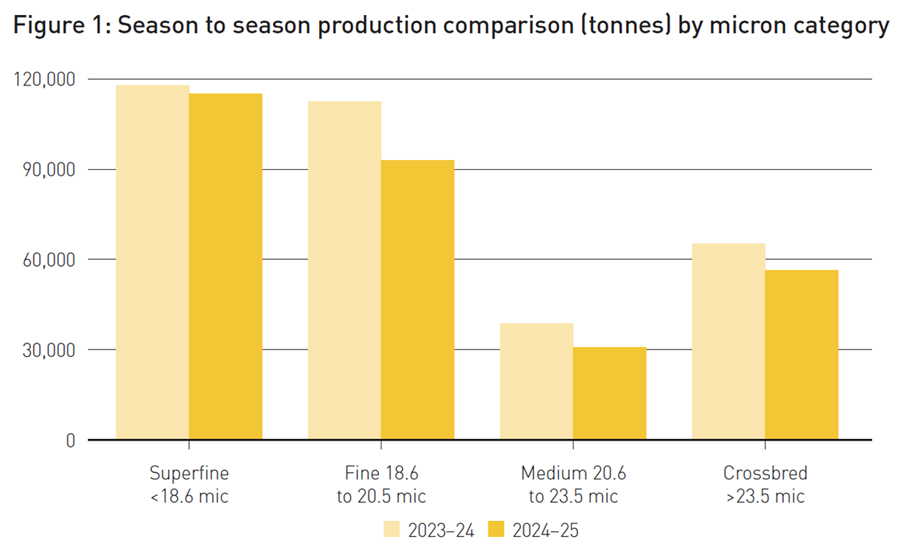

For the 2024–25 season, 39% of the Australian wool clip by greasy weight was tested by AWTA in the superfine category of finer than 18.6 micron. This is the highest ever production percentage of the clip recorded as superfine. Despite the total Australian wool clip being 11.7% lower, the superfine sector was just 2.3% below last year’s volume.

Fine wool of 18.6 to 20.5 micron comprised 31.5% of the Australian clip (17.4% lower volume than the previous season), whilst just 10.4% of the clip was the medium wool types of 20.6 to 23.5 micron (20.8% lower volume than the previous season).

The volume of broad/crossbred wool greater than 23.5 micron fell by 13.6% compared to the previous season. Interestingly, the percentage of the total Australian clip for broad/crossbred wool fell from the previous season’s 19.6% to 19.2% in 2024–25. Although wool greater than 23.5 micron accounted for 19.2% of the Australian wool clip by volume, it represented 7% of greasy wool value.

Australian wool prices in 2024–25

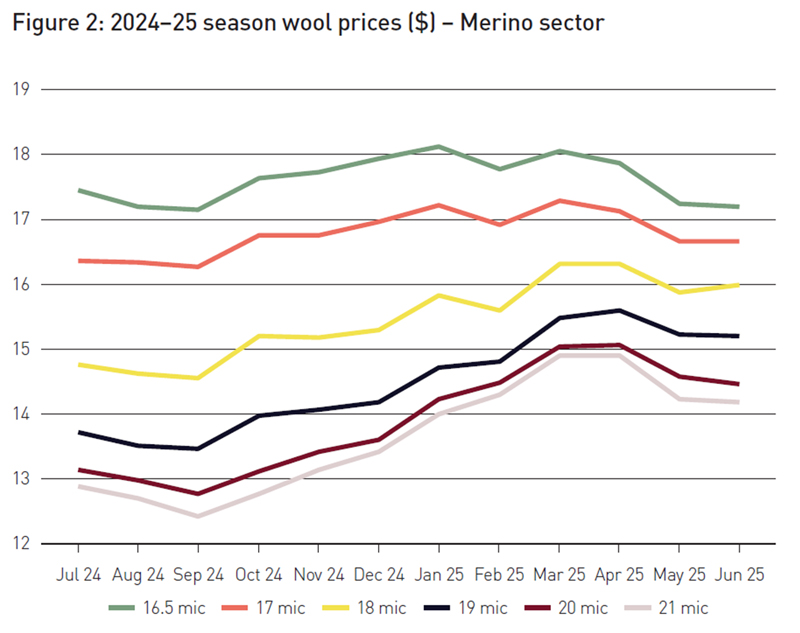

Since the start of the 2024–25 season, Merino types of 18 micron and broader have recorded handy seasonal gains of between 8.3% and 10.7%. This means prices within this wool type segment (which is the majority of the Merino clip) are 120 to 150 ac/clean kg better than at the start of the season.

The largest gains have centred more so around the 19 to 22 micron areas, as supply of these types lowered, partly due to the dry conditions which have pushed the general micron profile of the clip lower.

Merino wool types and descriptions finer than 18 micron have largely traded at around the same levels. The 16.5 micron indicator closed at values 1.4% lower than seen at the start of the season. This was the only quality that saw a decline in value.

Apart from a few of the best spinners types, the superfine market for the past three to six months has largely been the domain of the Chinese and, to a lesser extent, Indian manufacturers. The Italian weavers have been very sparing and discerning in the volume and quality of wool being sought.

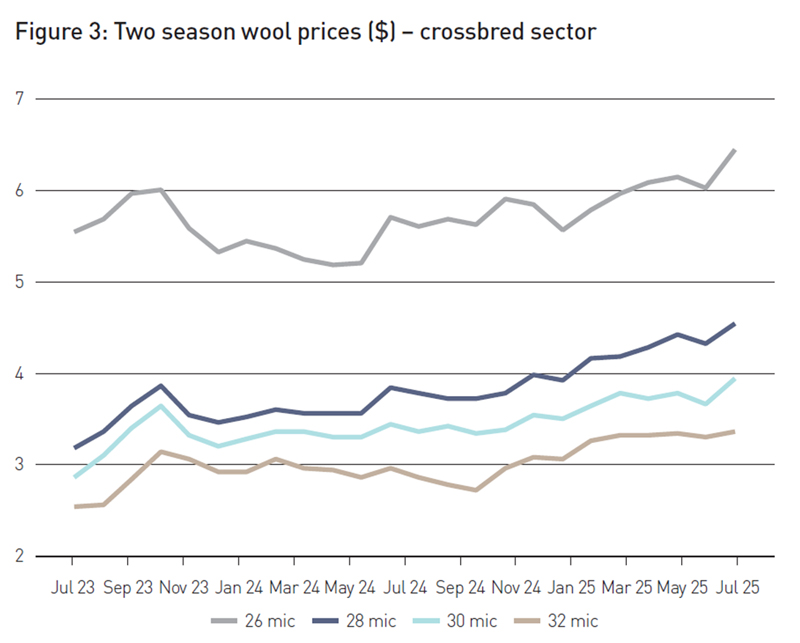

The crossbred wool market has steadily climbed for the past two years. Around 32% of value or about 104 ac/clean kg has been added to grower returns on average across the sector. The 32-micron indicator has increased by 32.2% in value, the 30-micron indicator by 37.5%, and the 28-micron indicator by 42.6%. The 26-micron indicator still managed a healthy gain of 16.2%.

Gains in this sector are indicative of advancements in the use of wool in homewares and interiors markets. Additionally, more affordable coats and outerwear apparel are being sought by shoppers looking for value.

These crossbred wool price improvements are coming off historically low price levels and are still massively below profitability levels required as a standalone production item, without factoring in the meat. But most growers are now able to get returns from their adult wool sheep that could at least go towards recovering the shearing costs. Shearing in this area of sheep production is now largely considered a management tool.

Australian wool exports in the 2024–25 season

According to the Australian Bureau of Statistics (ABS), China’s percentage share of Australian wool imports by volume in 2024–25 increased from 86.4% to 86.8%, although its import volume was 11.7% (33 mkg) lower than in the previous season. China’s percentage share of Australian wool imports by dollar value has also increased, from 84.1% to 84.4%, although its import value was 8.7% lower.

India increased its share of volume, from 5.1% to 5.4%, although its volume was 6.1% (1 mkg) lower than in the previous season. India also increased its import share by dollar value from 4.9% to 5.3%.

Whilst Italy’s volume share is very low at just 2.4%, it is 4.3% of the value when looking at export earnings. However, 4.3% is still a disappointing figure, because until recently it was usually well above 12% of Australia’s export value.

A noticeable change came from Czechia which lifted its market share by dollar value by 20.5%. This was because that export destination shifted a larger portion of its buying from the crossbred wool types into the purchase of more Merino wools, but more so reflecting the price gains of the broad wool sector over the past 12 months.

More information: www.wool.com/marketintel

This article appeared in the Spring 2025 edition of AWI’s Beyond the Bale magazine that was published in September 2025. Reproduction of the article is encouraged.