Market intelligence report

Here we look at the decreasing production volumes of Australian wool, the recovering wool prices, and the relationship between the Purchasing Managers Index and the EMI.

Australian wool production in the 2024/25 season

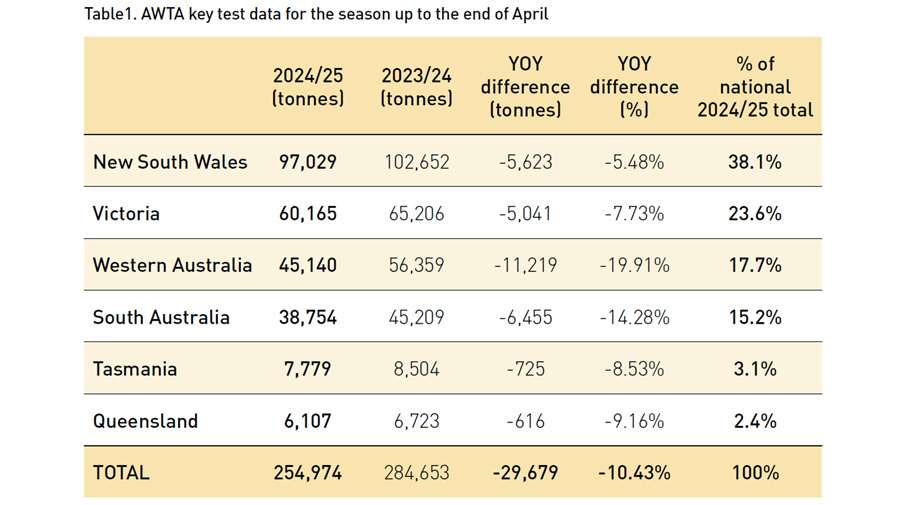

The Australian Wool Testing Authority (AWTA) tested 255.0 million kilograms (mkg) as at the end of April 2025 of the 2024/25 season. This is a 10.4% reduction in wool tested compared to the same 10 months of the previous season.

All states of Australia have seen decreases. The biggest production loss has been in Western Australia (down 19.9%) where producers are coping with dry conditions and adjusting their land use due to changes in Government policy. Drought-affected South Australia has also seen a big fall in production (down 14.3%) with reduced sheep numbers and lowered fleece weights/clean kgs.

NSW and Victoria are responsible for 61.7% of the national production, which is somewhat helping to hold up the national total.

Wool selling volumes at auction for the 2024/25 selling season by the end of sale week 46 (16 May 2025), compared to the same period in the previous season, has seen:

- 13.79% less wool offered – 1,385,675 bales offered compared to the 1,607,373 bales offered last season, a drop of 221,698 bales.

- 13.86% less wool sold – 1,276,506 bales sold compared to the 1,481,853 bales sold last season, a drop of 205,347 bales.

- Very similar clearance rates at auction – 92.12% compared to the 92.19% cleared last season.

- 12.55% drop in raw wool value, approximately A$250 million less clip revenue – A$1,742 million sold this season through the auction system compared to the A$1,992 million sold last season.

Australian wool production forecasts

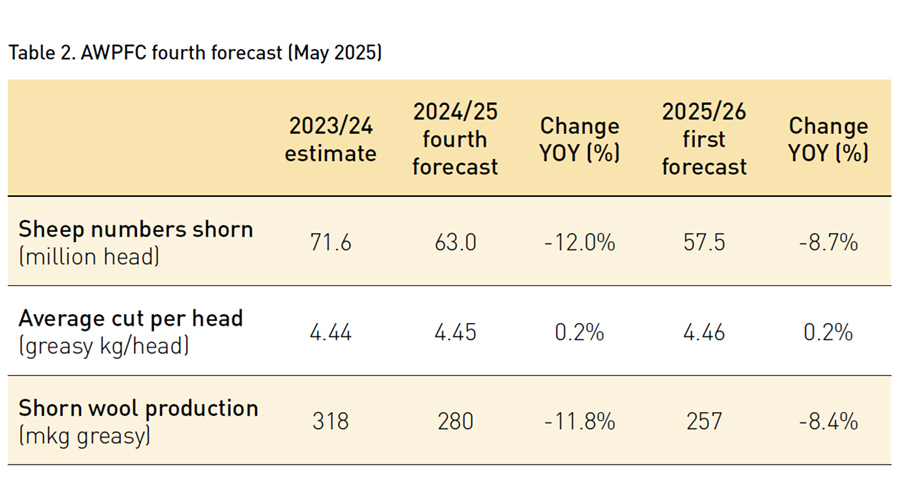

The Australian Wool Production Forecasting Committee’s (AWPFC) fourth forecast of Australian shorn wool production for 2024/25 is 280 mkg greasy, which is 11.8% lower than the 2023/24 season estimate – see table 2.

This 2024/25 forecast reflects the continuing drought conditions in western Victoria and South Australia and a decrease in the number of sheep shorn in all states. Commodity prices, input costs and variable seasonal conditions continue to impact sheep producers’ decisions regarding their enterprise mix, particularly in Western Australia.

Average cut per head in 2024/25 is forecast to be comparable with 2023/24, at 4.45 kg greasy (up 0.2%).

AWTA key test data for the 2024/25 season to the end of March shows small year-on-year changes in mean fibre diameter (down 0.3 microns), staple length (up 0.3 mm), staple strength (down 1.5 N/ktex) and yield (down 1.1%). VM was unchanged at 2.2%.

Sheep slaughter from July to December 2024 was up 29% compared with the same period in 2023 and was 58% above the five-year July to December average. Lamb slaughter was down 6% compared with July to December 2023 but remained 12% above the five-year average.

The APWFC’s first forecast of shorn wool production for the 2025/26 season is 257 mkg greasy, an 8.4% decrease on the 2024/25 forecast.

Australian wool prices

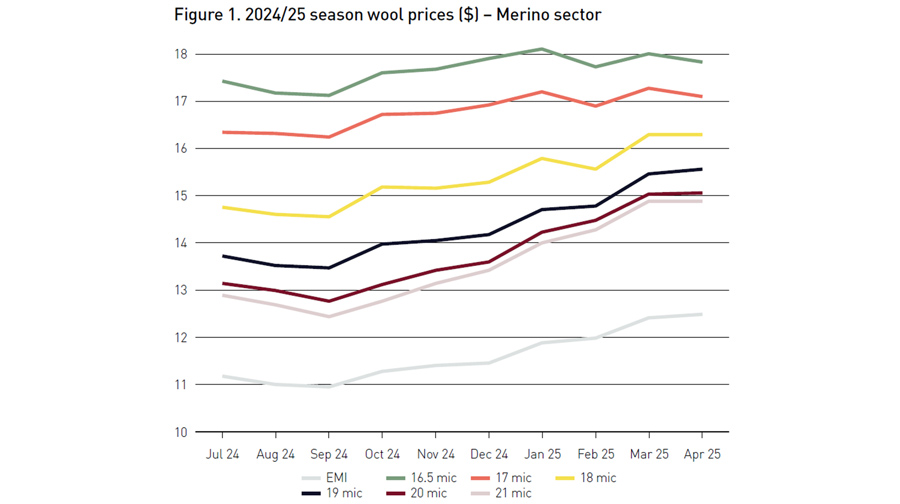

Since the start of the 2024/25 season, all wool types and descriptions have increased their values. The overall market value, as measured by the Eastern Market Indicator (EMI) has improved 11.8% or 132 ac/clean kg since 1 July 2024 – see Figure 1. However, when measured in the demand indicating USD EMI, the market has achieved just a 38 usc/clean kg gain, a 5.1% increase over the 10 months so far of this season.

In the Merino sector, all types broader than 18 microns have gained substantially, with 150 to 200 ac/clean kg rises registered. This represents a general appreciation of 12% in this wool type sector. A lowering supply – particularly broader than 19.5 microns – is the core factor, accompanied by the demand for uniforms, value suiting, jackets and knitwear items remaining solid to slightly strengthening during the whole season, before the emergence of tariff impositions.

Superfine Merino wools finer than 18 microns have been less sought after. Whilst gains of 40 to 80 ac/clean kg have been made (around 4% better), the prices are indicative of the struggling sales available at the top end of the apparel retail market. European buying at auction is particularly slack and unpredictable.

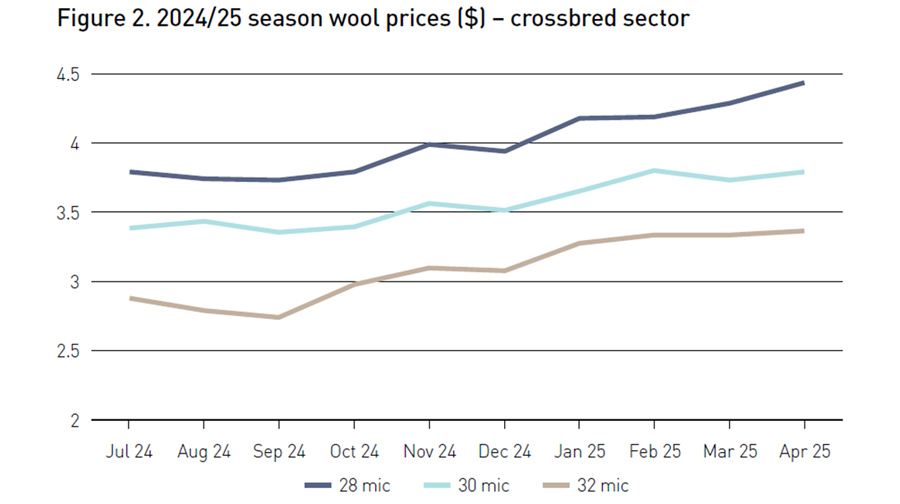

The crossbred wool market has steadily climbed since the start of the season – see Figure 2. Around 15% of value (50 ac/clean kg) has been added to grower returns, with most growers now able to get returns from their wool that are close to at least paying the shearing costs. Gains in this sector are indicative of homewares, interiors and cheaper coats being sought by shoppers looking for value.

The worst performing types in the market have been the cardings and oddment segment. Most types have remained near the same overall value throughout the season, indicative of the carbonisers struggling to create demand and the cheapness of competing fibres.

Purchasing Managers Index

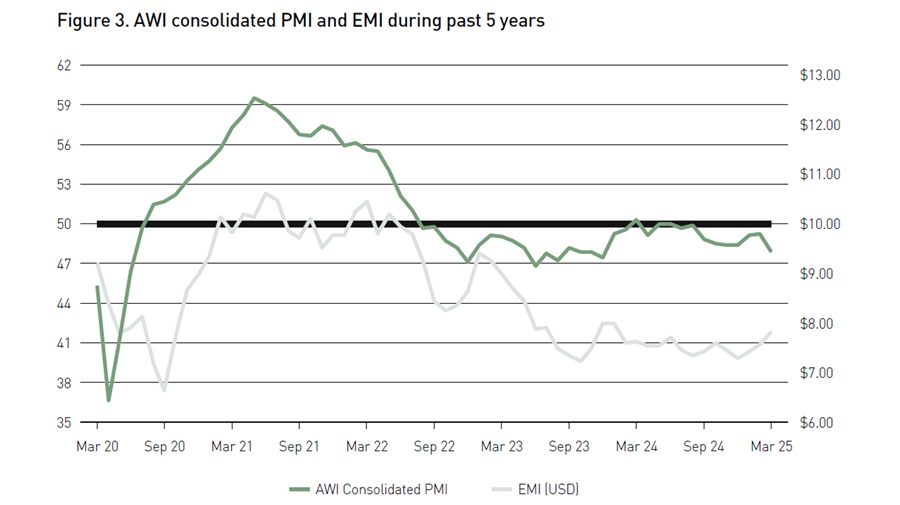

Unsurprisingly, the Purchasing Managers Index (PMI) Source: GlobalData) of most nations has taken a big hit in March/April due to the actions of the US. The AWI consolidated PMI (see Figure 3) measures an averaged sentiment derived from published data from:

- USA, down from 51.6 to 49.0 (-5%),

- Japan, down from 49 to 48.4 (-1.2%),

- Italy, down from 47.4 to 46.6 (-1.7%),

- South Korea, down from 49.9 to 49.1 (-1.6%)

- UK, down from 46.9 to 44.9 (-4.3%).

In somewhat of a shock, the individual country figure for China for March 2025 increased from 50.2 to 50.5 (+0.6%) which was its best PMI for a year (March 2024 was 50.8).

This article appeared in the Winter 2025 edition of AWI’s Beyond the Bale magazine that was published in June 2025. Reproduction of the article is encouraged.